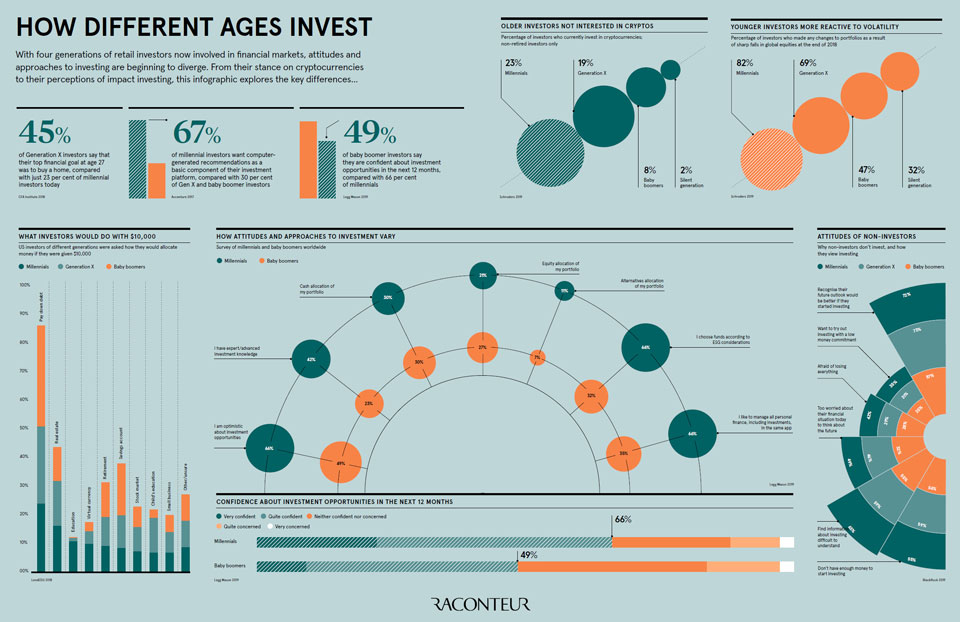

How Different Generations Think About Investing

This article is from Visual Capitalist, click here for full article.

Every generation thinks about investing a little differently.

This is partially due to the fact that each cohort finds itself on a distinct leg of life’s journey. While boomers focus on retirement, Gen Zers are thinking about education and careers. As a result, it’s not surprising to find that investment objectives can differ by age group.

However, there are other major reasons that contribute to each unique generational view. For example, what major world events shaped the mindset of each generation? Also, what role did culture play, and how do things like economic cycles factor in?

Finding Generational Discrepancies

Today’s infographic comes to us from Raconteur, and it showcases some of the most significant differences in how generations think about investing.

Let’s dive into some of the most interesting data:

- Investment Outlook

The majority of millennials (66%) are confident about investment opportunities in the next 12 months. This drops down to 49% when boomers are asked the same question.

- Volatility

How did different generations of investors react to recent bouts of volatility in the market?

82% of millennials made changes to their portfolios

69% of Gen X made changes

47% of boomers made changes

32% of the Silent Generation made changes

- Knowledge and Ability

In terms of investment knowledge, 42% of millennials considered themselves to be experts in the field. On the same question, only 23% of boomers could say the same.

- Financial Goals

Back when they were 27 years old, 45% of Gen Xers said their primary goal was to buy a home. Compare this to just 23% of millennials that consider a home to be their primary investment objective today.

- Managing Investments

The majority of millennials (66%) saw the ability to manage all aspects of personal finance, including investments, in the same app as being important. Only 35% of boomers agreed.

Similarly, 67% of millennials saw recommendations made by artificial intelligence as being a basic part of any investment platform. Both Gen Xers and Baby Boomers were more hesitant, with 30% seeing computer-based recommendations as being integral.

- Impact Investing

Millennials are twice as interested in ESG (environmental, social, and governance) investing, compared to their boomer counterparts. In fact, the majority of millennials (66%) choose funds according to ESG considerations.